Finding COVID-19 Resistant Stock Portfolios

During the COVID-19 global health crisis, all industries, countries, and people felt the massive effect COVID-19 had on our society. One of these destructive events was the effect the virus had on the stock market. Given the looming threat that humanity was facing the S&P 500 dropped a record 34% in just over one month. Several trillion dollars were wiped off the stock market in less than a month. Not only did this affected banks, but it cascaded over the world's economy and thousands of businesses needed to shut down due to their loss in revenue and outside investment.

This economic event spiked the interest of our team; we wondered what businesses were resistant to the panic COVID-19 caused in the stock market and if there was a portfolio that would be resistant to it. To analyze the stock market data, we first needed to obtain historical price metrics during that period. To effectively analyze companies that could resist the crash, we needed to choose companies large enough to resist price fluctuations to smaller economic events. Therefore, we limited the possible stock candidates to the stocks in the S&P 500. To select stock candidates for our resistant portfolio, we used linear optimization algorithms. Although this worked well, it only chose the best performing stock in our given period. We, therefore, had to opt for different strategies to effectively diversify our portfolio. However, diversification is difficult to measure effectively. The goal of diversification is to limit the risk posed by owning single stock and volatility. We, therefore, needed to consider this when developing our selection criterion.

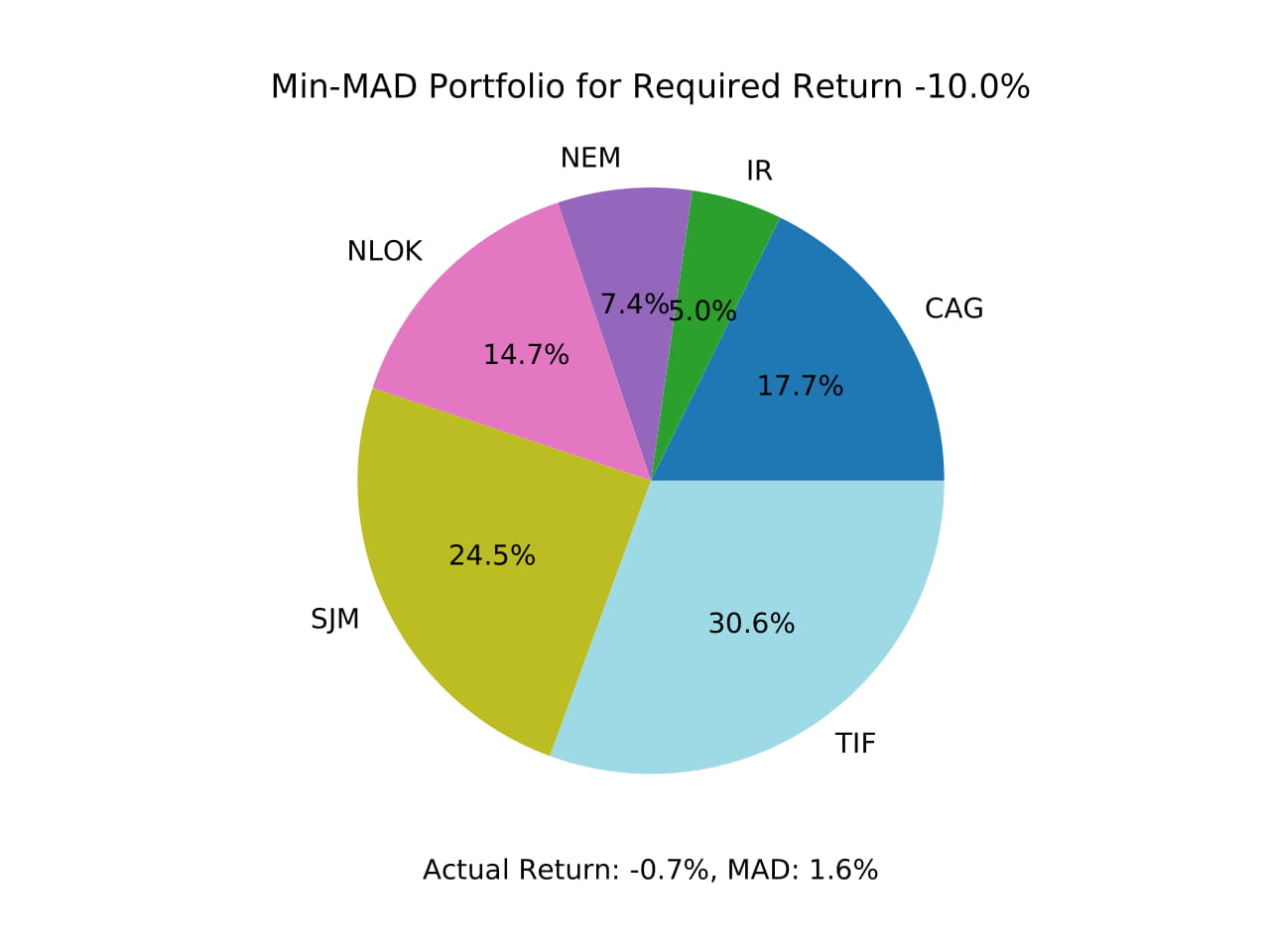

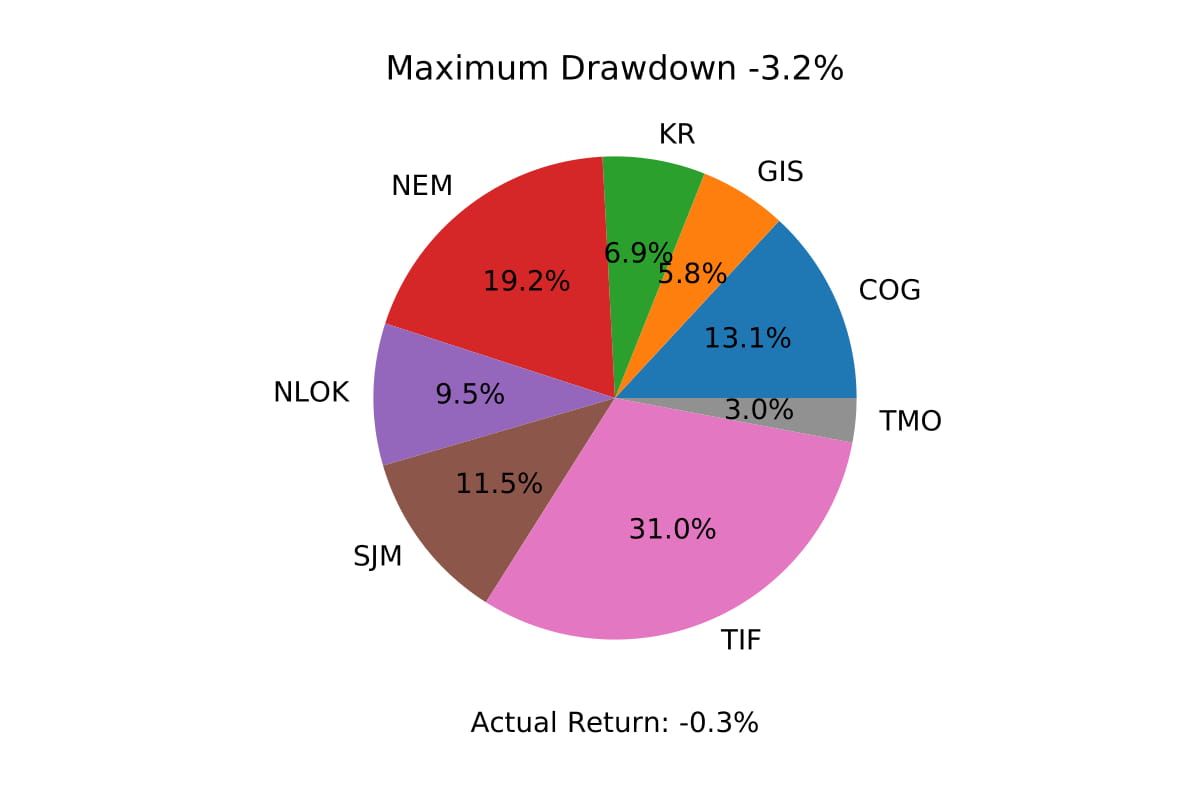

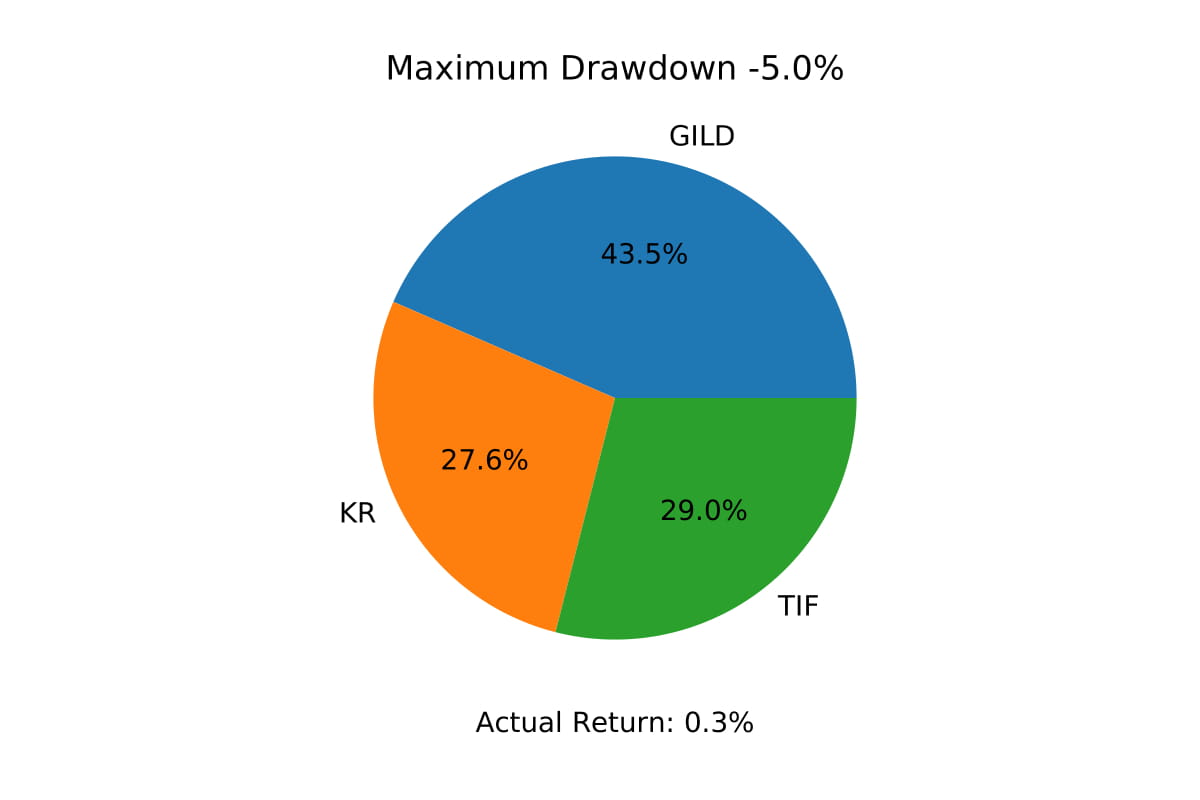

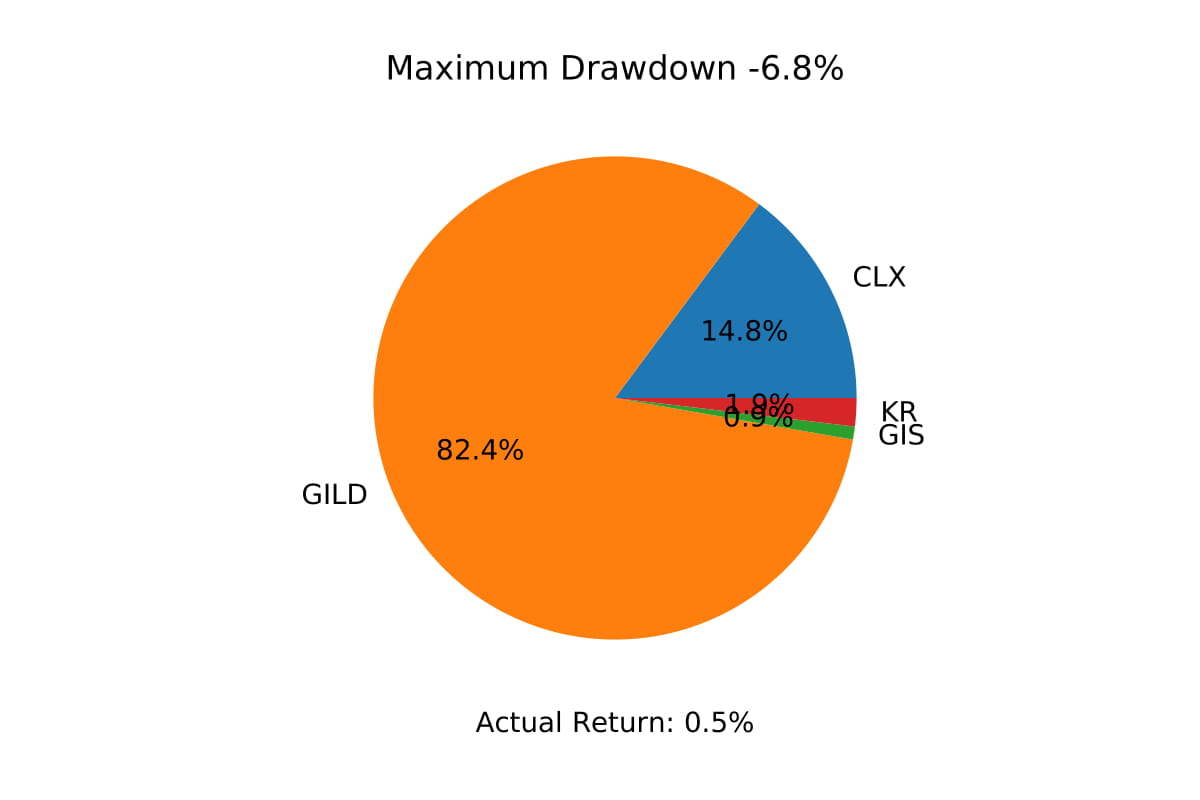

We opted to develop two linear programs with slightly different selection criteria. The first linear program used selection criteria to minimize the portfolio risk by minimizing the portfolio's volatility during the stock market crash. The second algorithm used a minimax approach, where the goal of the Linear program was to maximize returns while minimizing the drawdowns.

The above pie charts represent the portfolio's fund allocation that we obtained through the algorithms mentioned previously. To read the full report with further explanation of the methodology, mathematics, and analysis of the portfolios obtained, Click below to find the full published paper.

Full Paper